- Coupa’s readiness for the Japanese market reached enough level.

- Comparison of Ariba and Coupa, which have different product underlying concepts, becomes mandatory.

- Product selection without any comparison will lead the vendor’s sloppy work.

The event “Coupa Partner Sales Enablement“ in Tokyo on March 7 was a great opportunity to learn about Coupa’s current readiness for the Japanese market. And it was very clear that Coupa had already reached enough level to entry into the Japanese market.

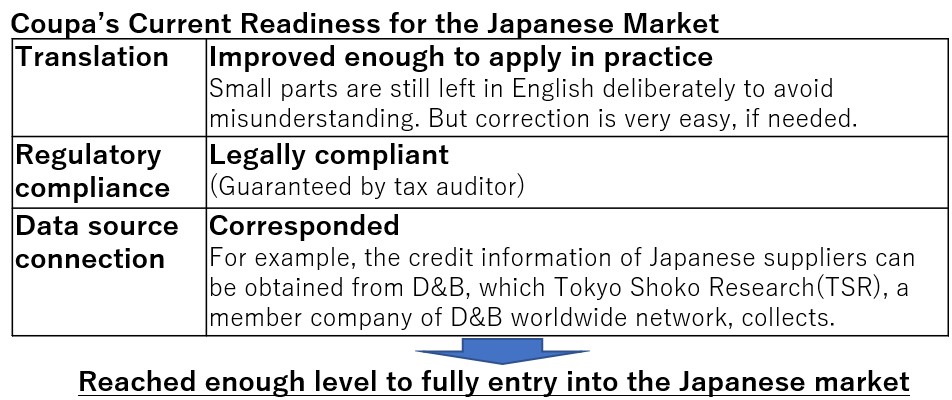

At the previous symposium in the last November, there were some inadequate points for full-entry to the Japanese market. However, only four months later, those issues had already been vanished.

So, in this blog post, I will describe the current status of Coupa (Japanese version) and why it is necessary to consider Coupa when we plan to implement indirect procurement solutions.

Note) The photos in this post have been approved by Coupa Japan.

Coupa’s readiness for the Japanese market has reached completion level!!

1) Translation to Japanese (Japanization)

First, I describe the current status of Japanese translation of Coupa. In the demo of “The 2018 Coupa Japan Symposium” on November 16 last year, there was a considerable inadequacy in the Japanese expression on the screen. Even if there was an accident that recent Japanese revisions could not be reflected sufficiently, it was a level that felt anxious about practical use. However, in the demo on March 7, great improvements were shown, and the inappropriate Japanese expressions are no longer found. It is a significant improvement in a short time.

Some of the “Recommendations” fields are still in English.

Coupa has functionality to show suggestions with “recommendation” items which are generated by comparing the actual values of KPIs with target value or community benchmark value (see also the community intelligence function below). However, when translated into Japanese, these seem to be difficult to understand. Therefore, I suppose it seems to have been left intentionally. In addition, however, there is only a small amount left, and if necessary, it is possible to translate it into Japanese, so I think it is no longer a problem.

For example, below is the Coupa “Insight” screen. There are no unnatural terms cannot understand anymore.

(2) Regulatory Compliance

In compliance with laws and regulations, the Electronic Bookkeeping Act (such as time stamps) is a mandatory requirement. In addition, there are laws and regulations that should be considered, such as the Subcontract Act. As of last November, Cooper did not support those requirements. And some attendees were wondering if they can really implement Coupa for practical use.

However, on March 7, the same day as the event, I heard that the tax auditors of the audit firm had guaranteed Coupa’s measures for regulatory compliance. Therefore, there are currently no concerns about Coupa’s compliance with Japanese laws and regulations.

(3)Correspondence to information source

In addition, there was also the problems of information sources corresponding to the Japanese market.

For example, Coupa keeps a supplier credit rating information inside which provided from external firms. And Coupa users can use it for examination of supplier’s credit risk. But this function is almost useless for Japanese companies if information on Japanese companies cannot be acquired.

However, I heard the arrangement with Dun and Bradstreet, which provide Japanese companies’ information collected by Tokyo Shoko Research (TSR), a member company of D&B worldwide Network, had been completed. In addition, cooperation with information sources for the Japanese market, such as multiple punch-out catalog vendors, has been promoted.

In this way, the issues against the entry into Japanese market in the last November had been solved sufficiently in this March demo. We understand that Ariba’s regulatory response took more than a year to complete. On the other hand, such a quick response only in four months shows the great eagerness of Coupa Japan and also Coupa Asia Pacific, I think.

Again, summarizing Coupa’s benefits

As a result, in the Japanese market, Coupa has become a true choice of modern e-procurement solutions along with Ariba.

The intuitive and easy-to-use features of Coupa is very attractive, as indicated by the high scores in the various product comparison reports. In the case of indirect procurement, poor usability leads a huge dissatisfaction of non-procurement employees and consequently, frequent procurement rule violations (Maverick Buying) could occur.

In addition, Coupa has unique and interesting features: Community Intelligence. Let me briefly describe this feature.

A group of suppliers that everyone says is better may be more reliable than of suppliers that specific person has chosen (which may be biased). Or data that reflects everyone’s opinion may be more accurate than survey data from a specific organization. Coupa’s concept of “Community Intelligence”, which emphasizes actual data in user companies, seems to be synonymous with Rachel Botsman’s best seller “Who Can You Trust?”, which tells the world is transitioning to “distributed (decentered) trust,” such as mutual assessment of Uber and Airbnb, rather than “institutional trust (based on a specific authority or system).”

Let’s look at a real example. The following is the content on the above-mentioned “Insight” screen.

The “Insight” screen is divided into three categories, “saving”, “efficiency”, and “Usage “, and key indicators (KPIs) are vertically arranged. On the other hand, the horizontal axis shows actual values such as “You (in-house actual)”, “Your Goal (in-house target)” and “Your Trend (in-house actual trend)”. Even if you can grasp your company’s situation with various indicators (KPIs) in real time, it is an attractive feature.

But that’s not all. The item “leaders” on the right side is the truly valuable feature of Coupa. It shows the average of the top-tier companies among the entire Coupa users and can be compared with your company.

We sometime find that the purchased survey report is useless, as we feel uncomfortable with the contents or benchmarking values. However, if actual values collected from other Coupa users are provided as comparison (benchmarking) data, it may be quite convincing.

In addition of indicators (KPIs) comparison, Coupa apply the power of user groups (community intelligence) to supplier management. For example, Coupa users can search for suppliers used by other companies and check what average scores (up to 5 stars) is given by other Coupa users. This other company’s assessment can be used to identify new candidate suppliers or to identify the risk of the currently own suppliers (in case when score is unexpectedly low).

In the case of Ariba, you will be required to use a group of suppliers registered and managed institutionally by Ariba, which called “Ariba Network” (therefore, suppliers belong to this mechanism must pay the usage fee to Ariba). Coupa, on the other hand, adapts community intelligence which can be share supplier status based on the assessment of community members. Between Ariba and Coupa, there seem to be differences in the underlying product concepts, such as the “institutional trust” vs. “distributed (decentralized) trust” described in the previous book “Who Can You Trust?”. Of course, both have advantages and disadvantages. Therefore, after comparing them, companies should make a careful and thorough decision as to which is appropriate.

Nightmare of monopoly – the reasons we need to consider Coupa in the Japan market

Of course, Coupa is not completely perfect. There are also many excellent points in Ariba, which has many implementation cases in the Japanese market. For example, Ariba’s supplier management functionality based on the Supplier Lifecycle Management (SLM) concept outperforms Coupa in terms of feature richness. For securing a proper supply base (supplier base), SLM is important, especially for direct materials where long-term close relationships with suppliers are mostly required (About these points, I have repeatedly explained the significance in my lecture etc.). However, for indirect procurement where normally exist many substitute suppliers, to what extent is SLM is required? … Thus, it’s useful to have multiple products that can be compared and examined in detail (if there is nothing to compare, it tends to proceed without thinking enough).

In addition, let us give one more bad example of that occurs when a product is becoming exclusive. At one Ariba implementation project, when degerming functional scope, such a conversation was held among members of the implementation vendor. “Oh well, whatever, I am not sure but English auction may be fine?”. This sloppy case with lack of careful and enough considerations really happened last year.

The English auction is an old-fashioned reverse auction method that takes time (sometimes a few hours) for bidding. On the other hand, Ariba and Coupa now offer other reverse auction methods – Dutch auctions and Japanese auctions, which can efficiently finish bidding event in a short period. As can be seen from the fact that were added afterward, these brings a great effect, if applied correctly.

However, when there is no other choice, and the implementation of the product (Ariba) is once decided, the vendor will tend to do the “easy and without thinking in depth” implementation, only according to precedents (as described above). As a result, unfortunately, it is assumed that any advanced auction methods have not been equipped in this case and enough effects have not been obtained at this company.

Conversely, this situation can be largely avoided if there is more than one product to compare. Vendors in a competitive position will make a clearer proposition that appeals comprehensively to prodct’s benefits. Also, for that purpose, vendors need to do their best in-house. However, in a monopolistic situation without multiple options, the product’s inherent effectiveness may not be fully exploited.

In order to avoid such a situation, it is valuable that the Coupa’s readiness to the Japanese market has been completed. From now on, after thorough comparison and examination between Ariba and Coupa, the selected one should be implemented as to maximize its effectiveness. And I believe that it is the procurement division that is good at making such comparisons properly and be able to lead the “best shopping”.

ピンバック: My Homepage